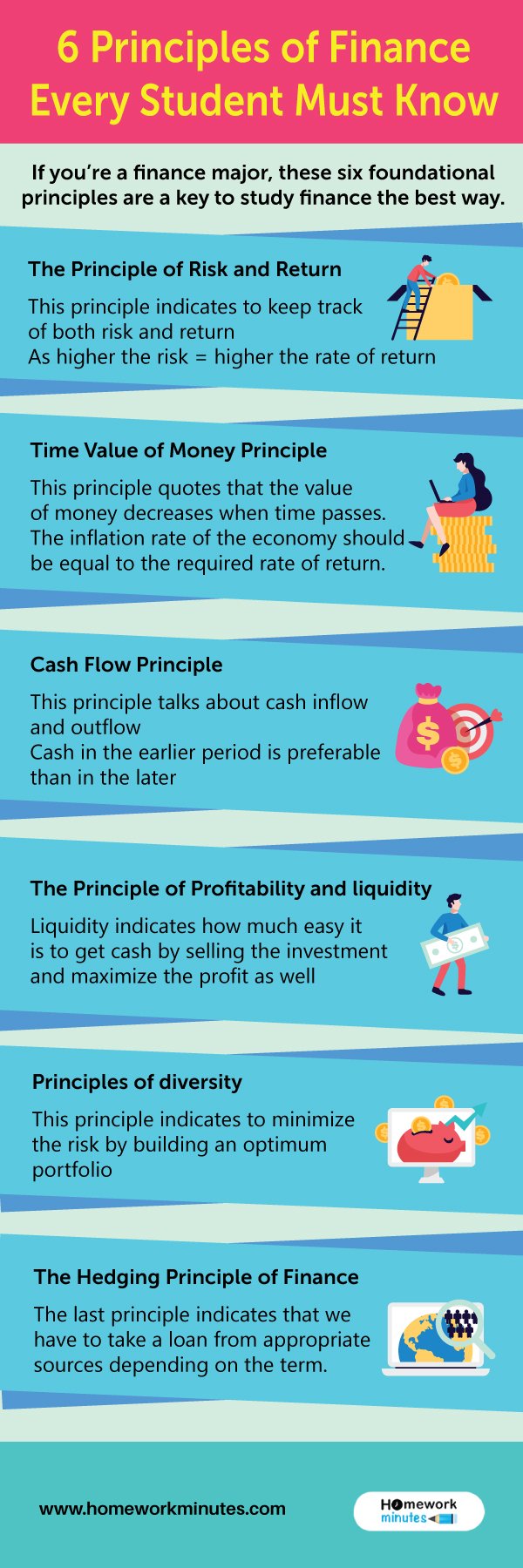

If you’re a finance major, these six foundational principles are a key to studying finance the best way. There are six basic principles of finance, quoting the value of money and other key terminologies of finance. In this guide, you’ll read about things that every student must know.

Also read:-

The Principle of Risk and Return

The first principle is the principle of risk and return, which indicates to keep track of both risks and return. The higher the reward, the greater is the risk. In such a case, a person then investigates into the types of bonds available for investment. For instance, an unsecured bond has no security, but the return is good, then the ability to risk the money awakens. Whereas there are secured government bonds, in which the return is low, but there is no risk, so the investor resists from investing.

Time Value of Money Principle

This principle quotes that the value of money decreases when time passes. According to this principle, one has to invest more to make more money since inflation is the continuous process of increase in the average price levels of the goods and services, as per the principle: higher the risk, higher the rate of return. Hence, the inflation rate of the economy should be equal to the required rate of return.

Cash Flow Principle

This principle talks about cash inflow and outflow. More cash inflow should take places in the earlier period than later. Since this principle also follows the time value principle, hence it prefers more benefits than the later years benefits.

The Principle of Profitability and Liquidity

This principle is quite important from the investor’s perspective since they have to ensure both profitability and Liquidity. The term Liquidity indicates how much easy it is to get cash by selling the investment More so; the investors have to ensure that they invest in a way that it maximizes the profit with a margin or lower or moderate risk level.

Principles of diversity

This principle indicates to minimize the risk by building an optimum portfolio. In simple words, distributing risks and investments over different businesses can reduce the investor’s overall risk if an investor avoids diversification, the investor’s overall risk increases.

The Hedging Principle of Finance

The last principle indicates that we have to take a loan from appropriate sources depending on the term. According to this principle, there are certain criteria to take a loan from appropriate sources. For the short-term fund, the finance should be from short-term sources, whereas for the longer-term or fixed asset financing, it should be from long-term sources.

If you need further help with more such finance-related topics, you can seek instant online assignment help from us. Chat with us now!